Understanding your personal finances involves knowing some important organizations in the financial world, especially credit bureaus. These bureaus, like Equifax, Experian, and TransUnion, gather financial data from various sources, such as banks and credit card companies. They then compile this information into individual digital credit reports.

This article will take a closer look at how these credit bureaus work. We’ll reveal how they figure out your credit score and highlight the kind of information they provide to help you manage your finances better. Keep reading to learn more.

Understanding Credit Bureaus and Information Collection

Credit bureaus operate as financial data repositories that aggregate and manage an extensive array of information constituting an individual’s credit history. This process involves a multifaceted approach to data collection, relying on a network of sources that contribute to the creation of comprehensive credit reports. Here’s a detailed breakdown of the mechanisms employed by credit bureaus in understanding and collecting financial data:

- Data Sources. Credit bureaus receive information from various sources, primarily lenders and creditors. These entities regularly submit data to credit bureaus, providing updates on individuals’ financial activities. Common contributors include banks, credit card companies, mortgage lenders, and other financial institutions. Public records, such as bankruptcies, tax liens, and court judgments, may also find their way into credit reports.

- Data Types. The information collected by credit bureaus encompasses a wide spectrum of financial data. This includes details on credit card usage, loan transactions, mortgage payments, and other credit-related activities. Each financial transaction is meticulously recorded, forming a comprehensive narrative of an individual’s financial behavior over time.

- Frequency of Updates. Credit bureaus regularly update their databases to ensure the information provided is current and reflective of an individual’s ongoing financial activities. Lenders typically report data every month, ensuring that credit reports capture recent financial behavior and payment histories.

- Personal Information. In addition to financial data, credit bureaus also collect personal information to identify individuals accurately. This includes names, addresses, Social Security numbers, and employment information. The accuracy of this personal information is crucial, as it forms the foundation for creating and maintaining an individual’s credit profile.

- Credit Inquiries. Credit bureaus track inquiries made into an individual’s credit report. These inquiries can be classified as “hard” or “soft.” Hard inquiries are typically associated with credit applications and may impact credit scores, while soft inquiries, often related to pre-approved offers or personal credit checks, do not impact credit scores.

- Public Records. Credit bureaus also monitor public records for any legal or financial events that may impact an individual’s creditworthiness. This can include bankruptcies, tax liens, and court judgments. Such records, when present, are factored into the overall assessment of credit risk.

Understanding the intricate web of data collection mechanisms employed by credit bureaus provides insight into the depth and richness of the information encapsulated in credit reports. This data collection process’s meticulous and continuous nature ensures that credit reports evolve in real-time, providing a dynamic snapshot of an individual’s financial history.

Decoding Credit Scores: FICO vs VantageScore

Credit scores are numerical representations of an individual’s creditworthiness, but the methods used to calculate them can vary. Two widely recognized scoring models are FICO Score and VantageScore, each with its unique approach to evaluating credit risk. Credit scores range from 300 to 850, with higher scores indicating better creditworthiness Let’s break down the key differences in the parameters they consider and the weight assigned to each:

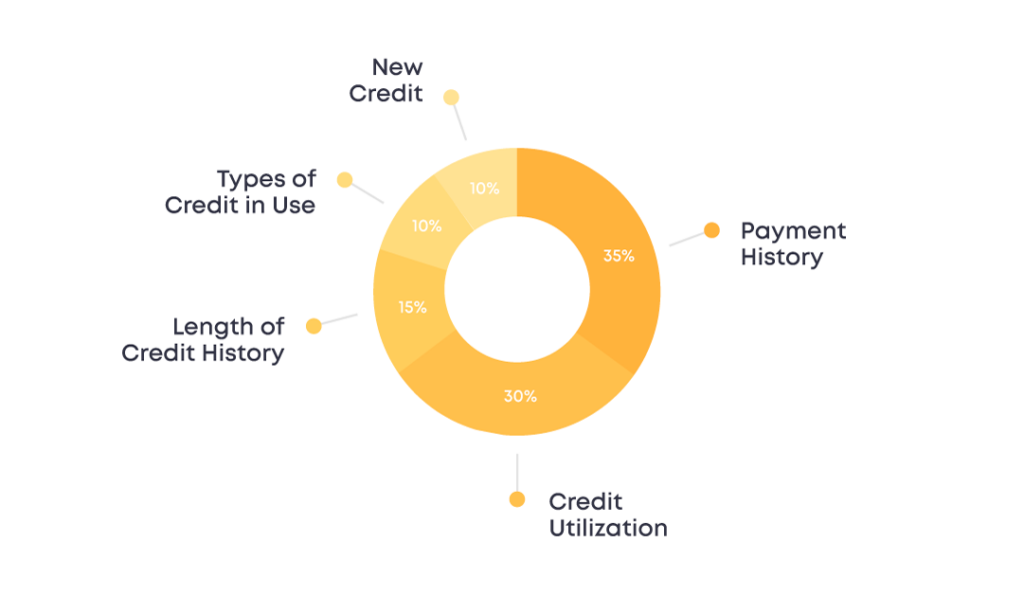

FICO Score

- Payment History (35%): The most significant factor in your FICO Score is your payment history. This includes the consistency and timeliness of payments on credit accounts, such as credit cards and loans.

- Credit Utilization (30%): This measures the ratio of your credit card balances to your credit limits. Maintaining a low credit utilization rate positively impacts your score.

- Length of Credit History (15%): The time your credit accounts have been established influences your score. A longer credit history is generally seen as more favorable.

- Types of Credit in Use (10%): FICO considers the various credit accounts you have, such as credit cards, mortgages, and installment loans.

- New Credit (10%): Opening multiple new credit accounts quickly can be considered a risk. FICO takes this into account when calculating your score.

VantageScore

- Payment History (extremely influential): Like FICO, VantageScore places significant emphasis on your payment history, considering factors such as the frequency and timeliness of payments.

- Age and Type of Credit (highly influential): VantageScore evaluates the age of your credit accounts and the diversity of credit types, rewarding a mix of credit.

- Percentage of Credit Limit Used (highly influential): Similar to FICO’s credit utilization, VantageScore assesses the ratio of your credit card balances to credit limits.

- Total Balances/Debt (moderately influential): This considers the total amount of outstanding debt across all credit accounts.

- Recent Credit Behavior (less influential): VantageScore looks at recent credit activity, including the number of recently opened credit accounts and the number of recent inquiries.

- Available Credit (less influential): The amount of credit available to you is considered, reflecting your overall credit management.

Understanding these differences is crucial for consumers as they manage their credit. While both models share some common elements, the emphasis and weight assigned to each parameter can vary, leading to differences in credit scores between FICO and VantageScore. Monitoring your credit and understanding the factors that influence your score empowers you to make informed decisions and work towards improving your creditworthiness.

Equifax vs Experian vs TransUnion

In the intricate realm of credit reporting, three major players dominate the landscape: Equifax, Experian, and TransUnion. Understanding the differences and nuances among these credit bureaus is crucial for anyone looking to comprehend, manage, and enhance their credit health.

Let’s unravel the distinct features, services, and advantages each bureau brings to the table, providing a clear roadmap for individuals seeking to navigate the complexities of their credit profiles.

Equifax

Based in Atlanta, Equifax has approximately 14,000 employees and does business in 24 countries. It is especially dominant in the U.S. South and Midwest and claims to be the market leader in most of the countries where it has a presence.

Main features

- Credit Report Lock and Alert System: Equifax offers a robust system that allows users to lock and unlock their credit reports at will, providing an additional layer of control over who accesses their credit information.

- Comprehensive Credit Monitoring: Equifax’s credit monitoring services include real-time alerts for various credit activities, enhancing identity theft protection and ensuring individuals are promptly informed about changes to their credit profiles.

- Credit Report and Score Watch Program: Equifax provides continuous monitoring, and alerts for changes in credit scores, offering a proactive approach to credit health management.

- User-Controlled Access: The ability to control access to credit reports empowers users to safeguard their information, adding a level of security and privacy to the credit monitoring process.

- Detailed Credit Reports: Equifax is known for providing comprehensive credit reports that encompass personal information, account histories, and public records, offering a thorough overview of an individual’s credit history.

Experian

With domestic headquarters in Costa Mesa, Calif., Experian originally handled reports for the Western U.S. The firm employs approximately 21,700 people in 30 countries and has its corporate headquarters in Dublin, Ireland.

Main features

- Experian Boost: Experian stands out with its innovative feature that allows users to voluntarily add non-traditional payment data, such as utility and telecom payments, potentially boosting credit scores for individuals with limited credit histories.

- CreditMatch Tool: Experian’s CreditMatch analyzes an individual’s credit data to suggest options tailored to their financial situation, streamlining the credit card selection process.

- Dark Web Surveillance: Going beyond basic monitoring, Experian includes Dark Web Surveillance, scanning for personal information on the dark web to enhance security against identity theft.

- Social Security Number Monitoring: Experian monitors the usage of an individual’s Social Security Number, providing an additional layer of protection against fraudulent activities.

- Robust Credit Monitoring: Experian offers comprehensive credit monitoring services with real-time alerts for various credit activities, contributing to early detection of suspicious activities and identity theft protection.

TransUnion

Chicago-based TransUnion, founded in the 1960s, has regional offices in Hong Kong, India, Canada, South Africa, Colombia, the United Kingdom, and Brazil and employs more than 10,000 people.

Main features

- Credit Lock Plus: TransUnion’s Credit Lock Plus provides a dual functionality of credit report locking and credit score monitoring, allowing users to actively manage access to their credit reports while staying informed about changes to their credit scores.

- CreditCompass Tool: TransUnion’s CreditCompass offers personalized insights and recommendations for improving credit health, providing actionable strategies for individuals to enhance their credit profiles.

- User-Friendly Tools: TransUnion is known for its user-friendly credit management tools, making it easier for individuals to navigate and understand their credit information.

- Detailed Credit Reports: TransUnion provides detailed credit reports that encompass personal information, account summaries, and public records, offering a comprehensive view of an individual’s credit history.

- Available Credit Monitoring: TransUnion’s monitoring services contribute to identity theft protection, providing real-time alerts and insights into changes in an individual’s credit profile.

In comparing these credit bureaus, each has its unique strengths. Experian stands out with its innovative Boost feature and advanced monitoring services. Equifax excels in comprehensive credit reporting and user-controlled access features. TransUnion’s strengths lie in its user-friendly tools and personalized credit insights. Leveraging the advantages of each bureau can provide individuals with a well-rounded approach to understanding and managing their credit health.

Summary

To sum it up, dealing with credit stuff can be tricky, so it’s smart to use all three big credit bureaus — Equifax, Experian, and TransUnion. This way, you get a complete picture of your credit. Each bureau has slightly different info and cool features, so using them helps you better understand your credit. By taking advantage of what each bureau is good at, you can handle the ins and outs of credit reports, make smart money choices, and keep your credit in good shape.