Platform

Web Platform

Industry

Automotive, FinTech

Duration

3 years, ongoing

Team

14 experts: 7 software engineers, 4 QA, Lead UI/UX designer, Project Manager, DevOps

The client was looking for a software development partner to help them undertake digital transformation. The company had a lot of inefficient and time-consuming manual processes, which called for automating. The goal was to optimize the long and exhausting processes of receiving car loans by going digital.

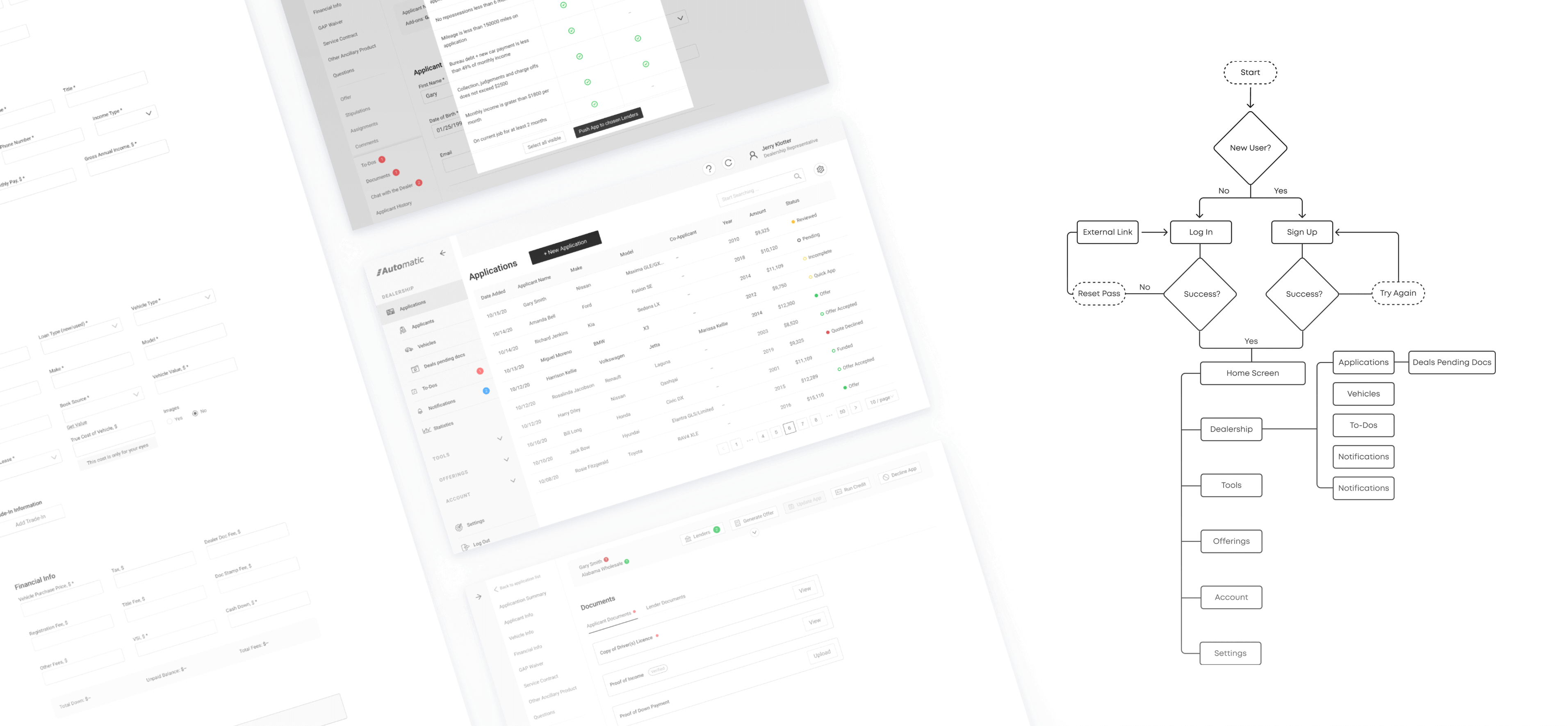

We’ve analyzed the offline auto loans business and the entire loan process based on the client’s information and our general niche research. As a result, we identified non-value-added activities and improvements to streamline every point in the process. The client also shared with us basic requirements and wireframes. The MVP version of the platform had basic functionality and included three key roles - Dealer, Lender, Admin.

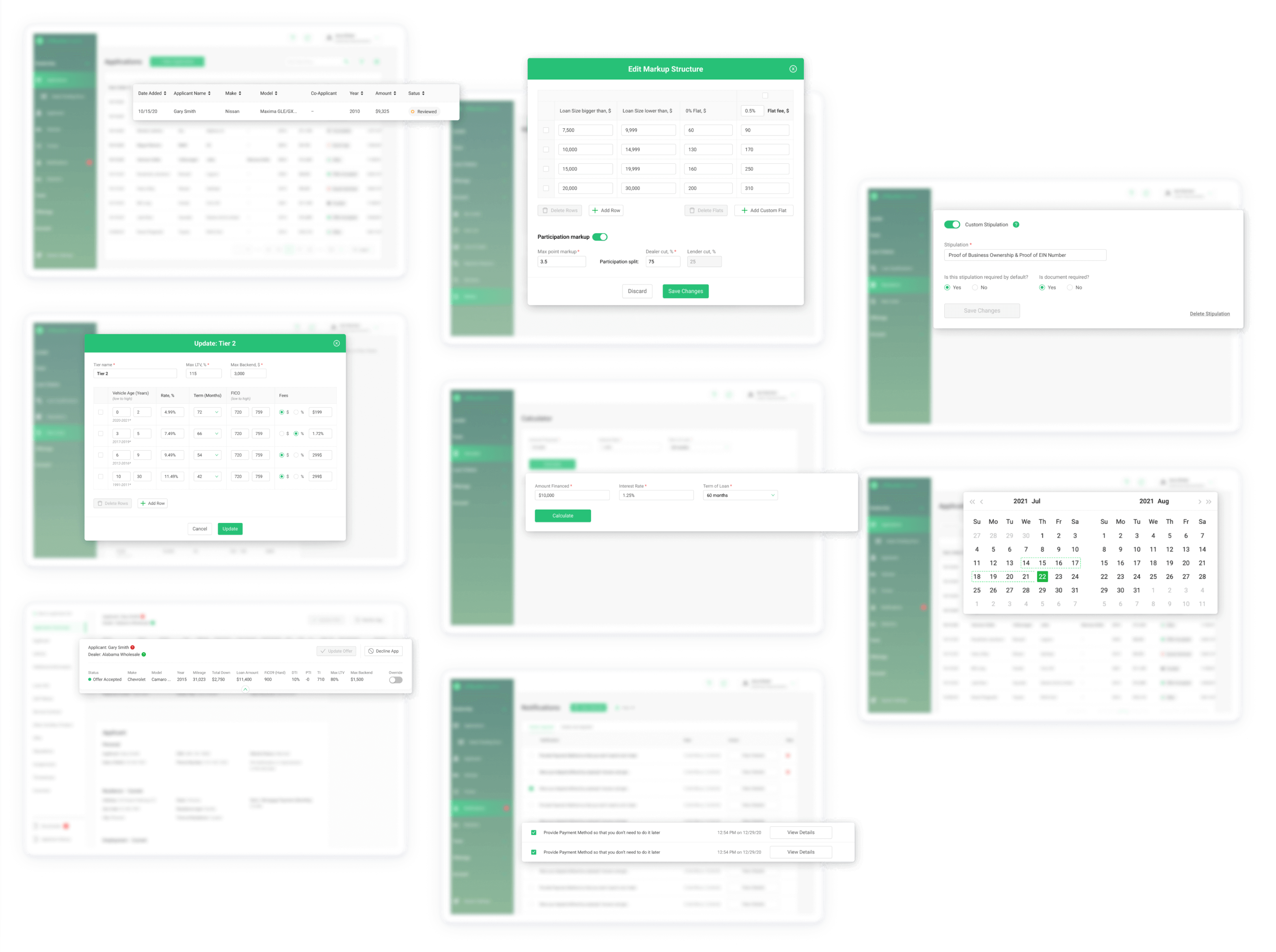

Having analyzed user testing and user feedback results, we helped to identify the project scope and implemented V2 of the web application. Our team extended the platform’s functionality by creating and adding a referral program and new platform roles - Vendors and API partners. We also made a list of F&I integrations that provided access to additional services users can obtain on the platform.

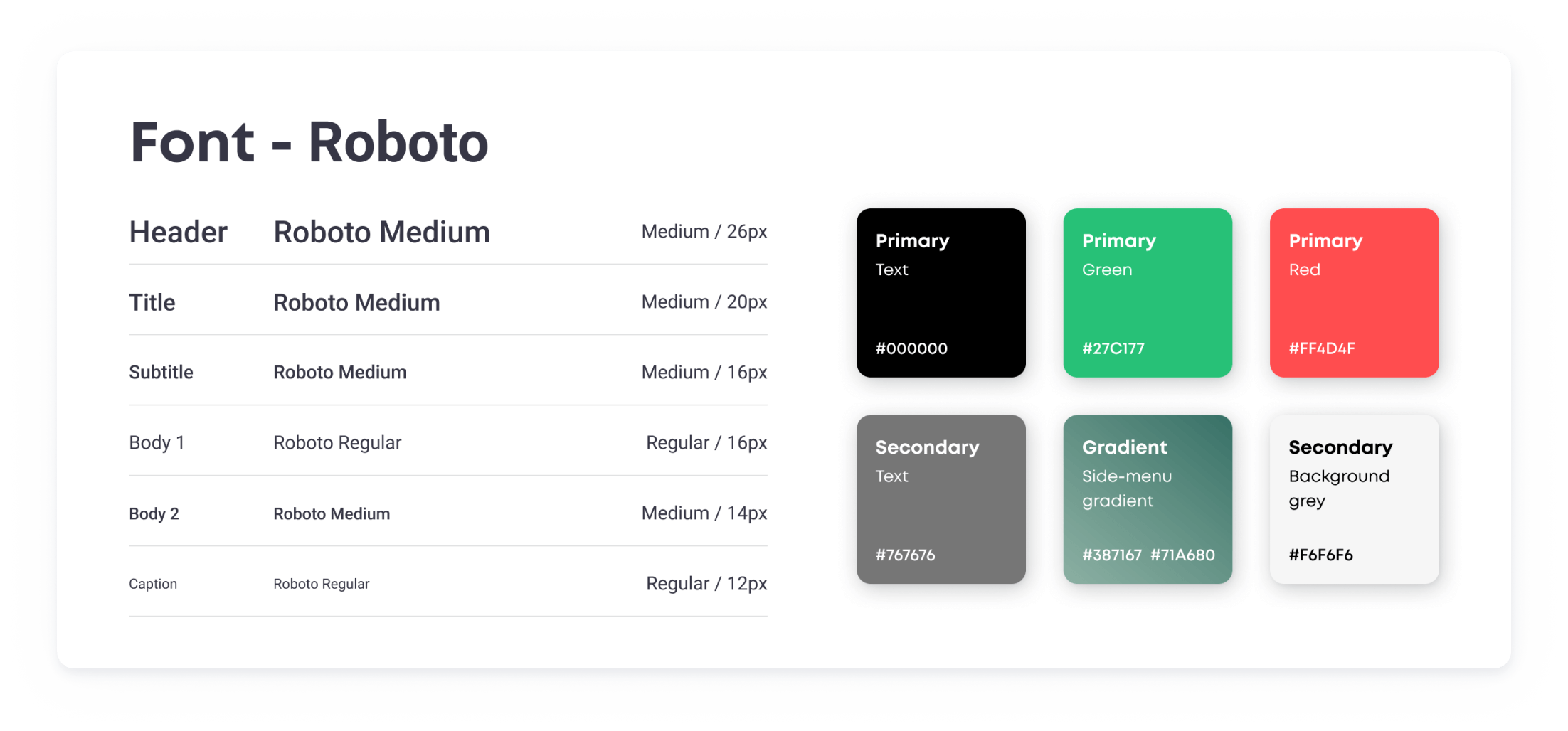

ORIL digitized the auto loan application process by adding complex algorithms for automated loan assessment. In addition, our designer developed a brand new design with intuitive UX and visually appealing UI according to the company’s identity.

ORIL team applied a thoroughly crafted planning and design process called Product Design Phase. This process is designed to maximize chances of delivering a product that satisfies core business objectives and is tuned for end-user’s convenience.

This process includes some of the following activities: competitive analysis, business-product objective prioritization, user flow creation, wireframing and prototyping.

ORIL team continues to support Automatic by delivering designs for new features on an ongoing basis.

ORIL’s design team worked closely with the customer and end users on choosing the right color palette, UI approach and overall look and feel of the product. The final UI design deliverables made a very complex and feature-rich product feel very light, friendly and accessible, while at the same time kept all of the platform functionality available within a few clicks.

ORIL helped design and implement an end-to-end business transformation by developing a fintech platform that minimizes the time needed for loan application processing and response. Long turnaround times and high operational costs were left in the dust. The company began winning more business from dealers. As a result, Automatic experienced the following benefits:

1,5k+

dealership organizations have registered onto the platform

17k+

applications submitted

2k+

loans funded

Java

Angular 8

MongoDB

Spring Boot

Hazelcast

Trusted Worldwide: Our Partner's Success Stories.

John Liu

Co-founder, Automatic

No spam

100% Useful content, always